Financial Services

Financial services continually forge ahead into new products, markets and clients, challenging the now and seeking new opportunities to be better.

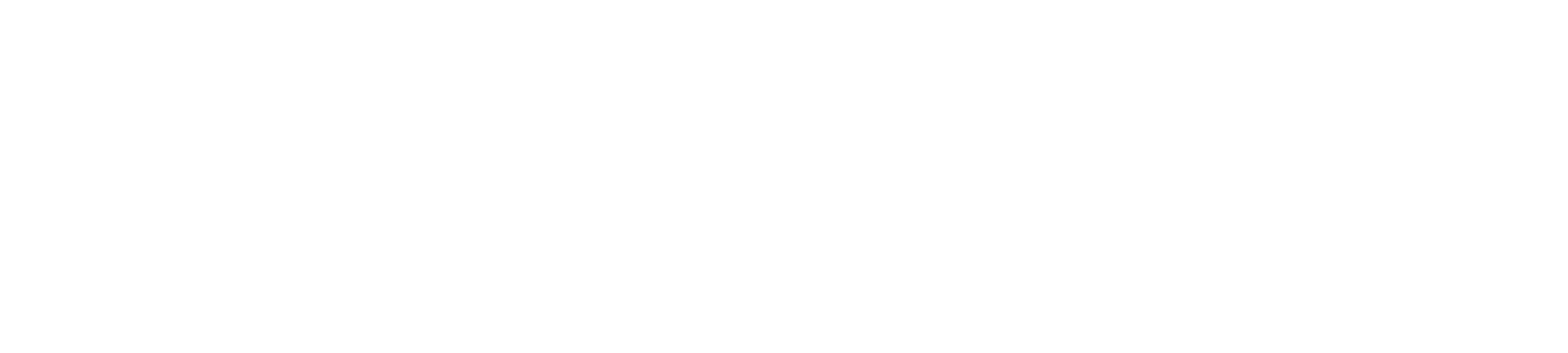

Artificial Intelligence & Machine Learning has the power to be transformational, enabling creativity and empowering innovation by helping firms to better strategise, optimise, mitigate risk, reduce costs, drive efficiencies, future proof and gain their own competitive advantages.

These are a sample of just some use cases we have partnered on throughout the Financial Services sector.

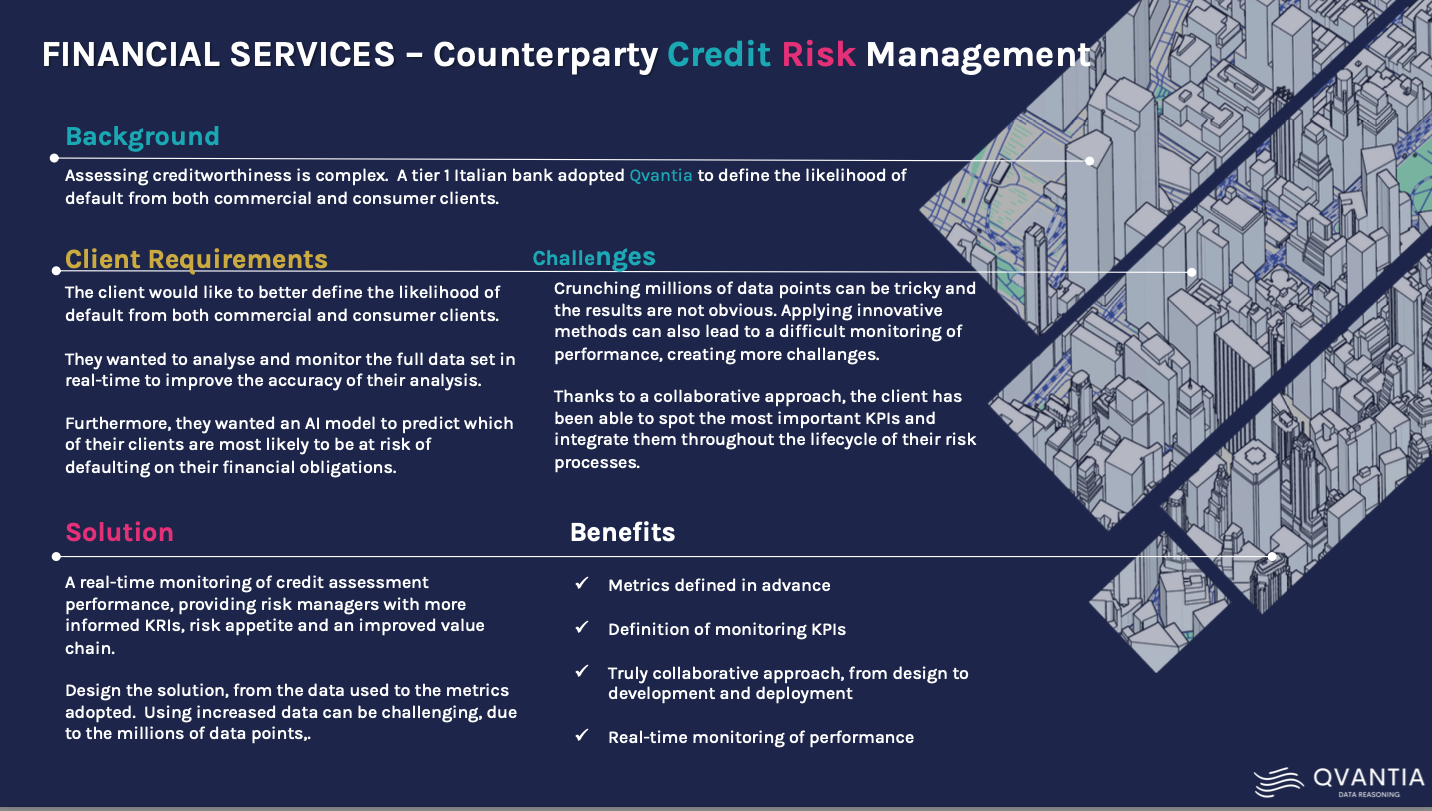

Insurance Fraud Detection

Insurance companies are using machine learning models to identify potential fraudulent claims and to also reduce false positive alerts, reducing investigative operational costs in car accidents by 45%.

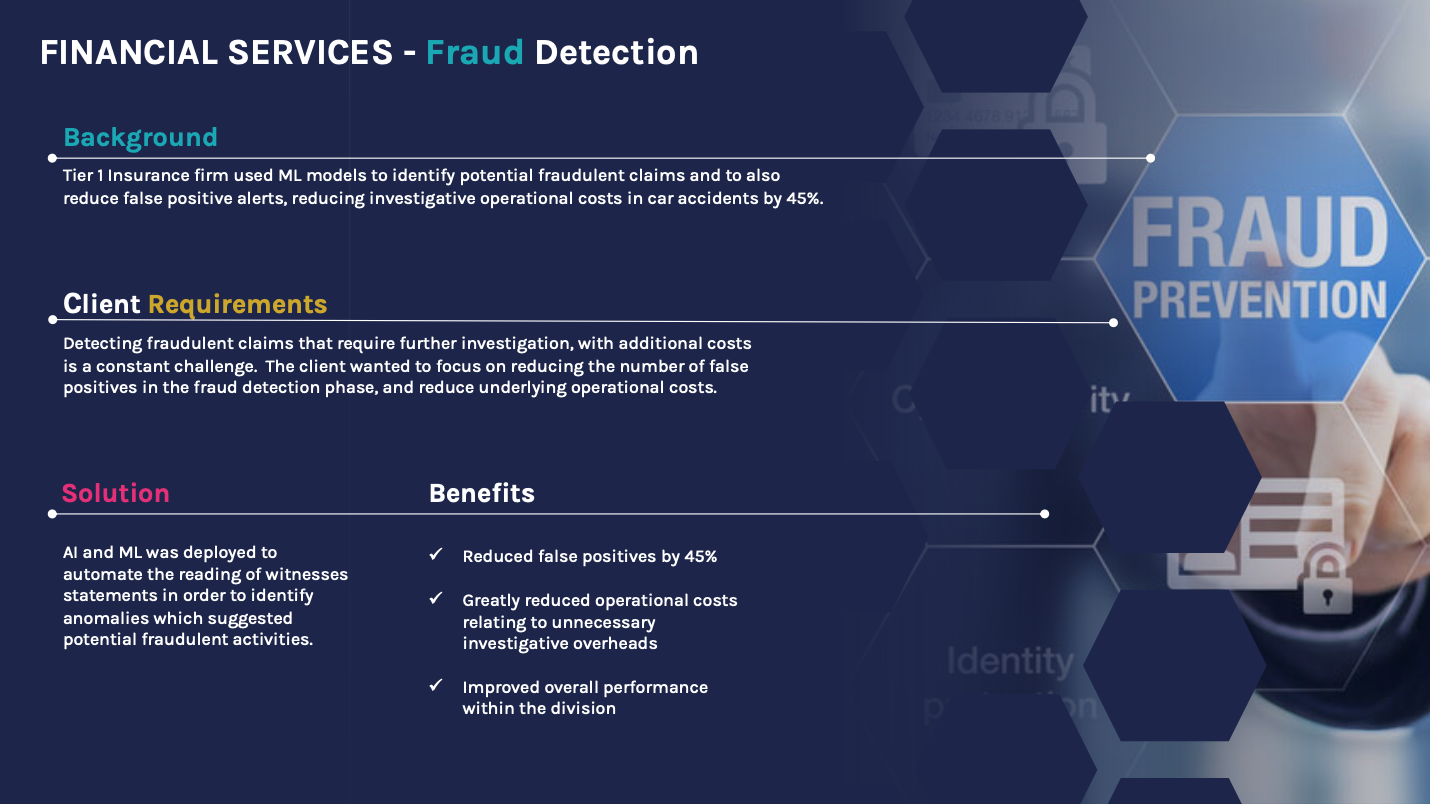

Collateral Optimisation

Asset Managers are leveraging AI to further optimise their rules based margin and collateral posting processes, driving enhanced optimisation capabilities, suggesting collateral optimisation transactions and / or rebalancing. AI is powering next level market solutions.

Balance Sheet Management

Using AI and ML to optimise collateral management, treasury and balance sheet impact. Addressing liquidity, timeliness, and operational constraints, which can place challenges resulting in inefficiency, under utilisation, trapped assets and incur costs.

Through AI firms can move towards a PnL led collateral management process that uses "what If" modelling and forecasting capabilities.

Pre-Trade Compliance

Capital Markets desks can use AI to super charge their pre trade compliance, monitoring, oversight and governance to ensure compliance and understand breaches. AI solutions demonstrate enhanced desk governance and oversight, whilst also driving process improvements.

Post Trade Control and Oversight

Capital Markets 1LOD functions are enhancing their post trade compliance, reporting, regulatory control oversight and overall governance through AI solutions to help broaden their lens of governance and oversight, enhancing the control framework and its operational effectiveness and further mitigating OR and regulatory alerts / events.

Trade Lifecycle Optimisation

With the backdrop of reducing settlement windows, consolidated time processing windows, increased commercial pressure on associated trade processing and balance sheet costs, AI can expedite and broaden the insight into trade processing challenges throughout the trade Lifecyle.

Request for Quote

Banks quote prices for a range of assets using a combination of experience, available inventory and a variety of models. Now through AI solutions we're able to bring this together for an enhanced process.

Cost to Serve

Security Services have been seeking more advanced cost to serve analytical frameworks. Through AI derived solutions they are able to assess the true cost of meeting their customer requirements. With the broader objective of determining costs to streamline supply chain planning and decision-making to cost-effectively meet customer demand and ensure quantitative sales P&L transparency.